All About Electric School Bus Tax Credits

School districts can access federal tax credits to offset electric school bus costs. Learn more!

NOTE: The budget reconciliation bill signed into law in July 2025 eliminates the use of the 45W and 30C tax credits after certain dates. The 45W credit will be eliminated for any vehicle acquired after September 30, 2025, and the 30C credit will be eliminated for refueling property (including electric vehicle charging installations) placed in service after June 30, 2026. On August 21, 2025, IRS provided new information about the term "acquired."

Disclaimer: This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, accounting or legal advice. This resource is a summary of final guidance on the elective pay provision released by the IRS on March 5, 2024, along with a summary of the 30C Notice of Proposed Rulemaking released on September 19, 2024. This guidance may be superseded by any changes made by the IRS upon further iterations of guidance.

Although every effort has been made to provide complete and accurate information, WRI makes no warranties, express or implied, to the accuracy of this summary and assumes no liability for its use. You are strongly encouraged to review the official IRS guidance or any subsequent versions of the guidance the IRS may issue.

Federal incentives like the Alternative Fuel Vehicle Refueling Property Credit (30C) can reduce the cost for a new electric school bus (ESB) as well as charging infrastructure. School districts can access these incentives through the IRA’s elective pay mechanism, which provides a new and streamlined way for tax-exempt entities to access these tax credits.

The Alternative Fuel Vehicle Refueling Property Credit (30C): a federal tax credit that allows tax-exempt entities to claim a credit for up to 30% of the cost of qualified property, such as electric school bus charging infrastructure. This 30% federal tax credit calculation is subject to a few requirements, including prevailing wage and apprenticeship employment, the qualified property being installed within eligible low-income or non-urban communities, and a cap on the value of the credit at $100,000 per item of property.

Elective Pay (or “Direct Pay”): the mechanism by which schools can claim the IRA clean energy and clean vehicle tax credits and receive a payment upon successful filing.

To help districts take advantage of these credits in their school bus electrification projects, this article covers:

- Elective pay and relevant clean energy tax credit, including the proposed rulemaking on the Alternative Fuel Vehicle Refueling Property Credit (30C)

- The IRS pre-filing registration process and general considerations for elective pay

- Combining tax credits with grants and loans

- Additional resources and partners

The Inflation Reduction Act Available Tax Credits for School Districts and Elective Pay Provision

The Inflation Reduction Act, enacted in August 2022, established and expanded tax credits for clean energy and climate investments. The most relevant federal tax credit for electric school buses is the Alternative Fuel Refueling Property (Section 30C) tax credit.

For the first time, school districts and other tax-exempt entities can access this credit through the elective pay mechanism.

Elective pay (also known as direct pay) is a mechanism established by the IRA that allows tax-exempt entities, like school districts, to claim these credits and receive a cash payment after successful filing. This provides a new ability for school districts to utilize tax credits to invest in clean energy and climate projects like electric school buses and charging.

Tax Credit for Alternative Fuel Refueling Property (Section 30C)

The Inflation Reduction Act of 2022 allows for a federal tax credit up to 30% of eligible project costs for electric school bus charging infrastructure in certain areas. This tax credit, known as Section 30C, is subject to prevailing wage and apprenticeship requirements and is available to school districts in low-income and non-urban areas.

It allows for a credit of up to 30%, capped at $100,000 per qualified item of electric school bus charging infrastructure. Each port on a single charger counts as its own qualified item of 30C property so eligible school districts installing multiple chargers may receive more than $100,000 in tax credits, depending on eligible project costs. However, if a school district does not meet prevailing wage and apprenticeship requirements, the credit amount is capped at 6% of project costs.

Section 30C allows for a tax credit of up to 30% of the cost of each charging port for electric school buses.

Eligibility for 30C

Please note that the 30C tax credit is set to expire on June 30th, 2026.

To help determine location eligibility, districts can use the Department of Energy’s Argonne National Laboratory 30C Eligibility Locator which demonstrates if the project location falls within an eligible census tract.

In order receive the full value of the 30C tax credit, laborers and mechanics employed in the construction, alteration and repair of the charging infrastructure will need to be paid at least a prevailing wage. It is also critical that apprentices from registered apprenticeship programs are utilized for a certain number of hours. For more information, please visit IRS’s website.

The 30C credit is available to government entities, like school districts, and other tax-exempt entities. The Notice of Proposed Rulemaking (NPRM) provides the option for school districts to choose between a reduced purchase price (via third-party installer) or an elective payment by the school district, whichever is more beneficial. When eligible property is placed in service, the seller must clearly disclose the amount of the 30C credit that the buyer (in this instance, the school district) would be eligible for.

However, when purchasing charging infrastructure, under the proposed rulemaking it is required that the charging company disclose to the school district whether the tax credit is included in the purchase price. If the credit is included in the purchase price, meaning that the seller will be claiming it themselves, then the school district cannot claim the 30C federal tax credit through direct pay.

Calculating 30C credits

For purposes of calculating the section 30C credit, a single item of 30C property is defined as each charging port for recharging property. Additionally, section 30C credit includes associated property if it is a “functionally interdependent property” and an “integral part” of the 30C property. Bidirectional charging equipment is an eligible section 30C item of property.

To determine the total cost for each charging port, which the 30% credit is based on, take the sum of:

- The cost for that charging port

- The cost for directly attributable and traceable property, such as the pedestal mount

- The pro-rated share of the cost of other associated property, such as the smart charge management system

Then, to find how much money the tax credit may be, multiply that sum by 30% -- or 6% if prevailing wage and apprenticeship requirements aren’t met. Be aware that the total tax credit can be no more than $100,000 per charging port.

For an example of how the 30C credit is calculated, please see our 30C two-pager.

Prevailing wage and apprenticeship requirements

When determining prevailing wage and apprenticeship requirements, the notice of proposed rulemaking would provide that multiple 30C properties will be treated as a single 30C project if the items of eligible property are constructed and operated on a contiguous piece of land, owned by a single tax-exempt entity like a school district, placed in service in a single taxable year, and one or more of the following factors is present:

- the properties are described in one or more common environmental or other regulatory permits;

- the properties are constructed pursuant to a single master construction contract; or

- the construction of the properties is financed pursuant to the same loan agreement.

This means that if districts meet any of the above factors, they will only need to demonstrate prevailing wage and apprenticeship requirements once for the entire project, rather than port by port.

For more information on filing for the credit, please see Electrification Coalition’s annotated tax form for this credit, which is required for all Section 30C property a school district will file for (Form 8911).

Learn more about this tax credit!

| Notice of Proposed Rulemaking for Alternative Fuel Refueling Property Credit (30C) | |

| Maximum credit value | Up to 30% of project costs, with a cap of $100,000 per single unit of charging infrastructure |

| Geographical restrictions | Low-income communities or Non-urban areas (see Argonne tool for eligibility) |

| Bonus credits | Must meet prevailing wage and apprenticeship requirements to receive up to 30% of project costs; otherwise, maximum is 6% of project costs |

| Definition of completed project | Placed in service (further definition pending final guidance) |

| IRS suggested paperwork to demonstrate completion |

|

Process for claiming elective payment for electric school bus-related tax credits

Elective pay became eligible after December 31, 2022 and is accessible once a project has been completed. Just like how individuals pay taxes after the end of the calendar tax year, school districts will claim elective pay at the conclusion of the tax year in which the project was completed.

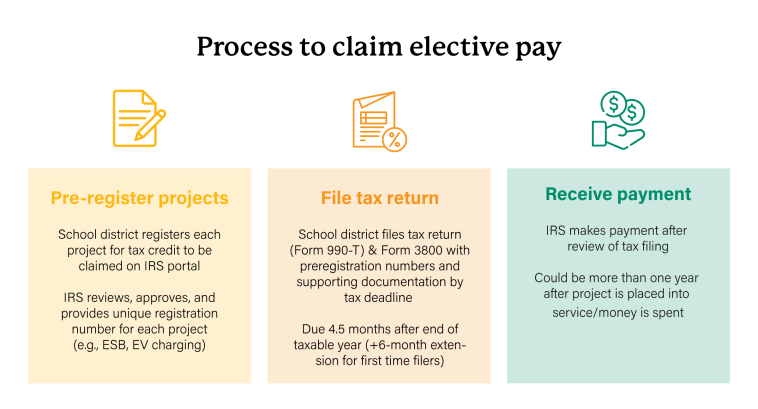

There are three basic steps to claim elective pay:

Once a school district has received its electric school buses and/or installed charging infrastructure, the district can begin the process of claiming elective pay by completing a pre-filing registration with the IRS.

This pre-filing process allows the IRS to verify the projects school districts wish to claim for the credits. Districts can begin the pre-filing process once all the projects for which they’re seeking credits are completed. The underlying credit includes a definition of “completed project.”

The pre-filing registration process requires that school districts submit certain information. Schools should consider the following items when submitting their pre-filing registration:

- Identify the school district (standard taxpayer identifying information such as name, address and EIN)

- Identify what credits the school will be applying for (e.g. 30C)

- Identify each eligible project and/or property that is attributed to the applicable credit (e.g., each delivered bus), including any solar and other non-transportation projects, to pre-register all in one batch

- Identify and collect documents to prove project completion (e.g., VIN numbers, certificate of title showing ownership, time of sale documents, copy of a registration document issued by a government authority.)

To claim elective pay, school districts should pre-register eligible projects then submit an annual tax filing.

According to IRS’s Pre-Filing Registration User Guide, the IRS recommends pre-filing at least 120 days before the annual filing deadline, to provide enough time in case IRS requests any amendments to the pre-filing. For tax-exempt entities like school districts, the annual filing deadline is 4.5 months after the end of their taxable year. For first-time filers for the 2023 calendar year or a fiscal year that ends before November 30, 2024, the IRS is providing an automatic extension for annual filing of up to 6 months after the annual filing deadline (e.g., instead of the annual filing being due on May 15, the deadline is extended until November 15). Additionally, tax-exempt entities will be able to request a 6-month extension for any filing year by using Form 8868. At the successful completion of pre-filing registration, school districts will receive registration numbers that must be included in an annual tax return.

Elective pay is available for those eligible tax credits from taxable years after December 31, 2022, through December 31, 2032. IRS has issued guidance for tax-exempt entities that do not have an established tax year, including any school districts, to file under their standard accounting period (i.e., fiscal year) or use a calendar year tax year (i.e., January-December) that differs from their standard fiscal year. Thus, districts have two options to determine their taxable year when filing:

- Elect to use the calendar year as a tax year. Filing under a calendar year allows applicable projects placed into service in 2023 under the 2022 Fiscal Year (for example, July 1, 2022 through June 30, 2023) to still be claimed through elective pay. For an example of this, please see the timeline below.

- If electing to use a calendar year instead of their fiscal year, school districts should ensure that they maintain clear records including a reconciliation of any difference between their regular books of account and their chosen taxable year.

- This option is only available for first time filers who do not have a defined tax year already (i.e. have not filed an annual tax return with the IRS previously)

- If a school elects to use a calendar year that differs from their typical fiscal year, it can shift its tax year back in the future, and IRS will be releasing instructions and information on this process (see Q23).

- Use the school’s standard accounting period, or fiscal year. For most school districts, this would likely run from July 1 to June 30.

General considerations for applying for elective pay

Here are additional considerations for districts applying for elective pay.

- Filers should submit all projects for pre-filing in one batch to streamline IRS review, including any non-ESB projects.

- Any EIN used to apply for elective pay can only be used once during any fiscal year.

- School districts should communicate early with their district’s and/or local government’s finance offices, as relevant, to be aware of any other potentially eligible projects happening during a fiscal year so that pre-filing for all applicable credits can be completed together.

- As noted in the IRS User Guide, after a pre-filing registration application is submitted, the school’s account will be locked while the IRS reviews the application, which can take up to 120 days.

- Submitters should start communicating early with their legal and financial offices to ensure a streamlined and effective filing process.

- During this process, school districts should identify who at the district will be submitting the pre-filing registration application. If anyone at the district already has an ID.me account associated with the district, that person will likely be the person to submit the pre-filing application. For example, if a district has received American Rescue Plan Act (APRA) funding, then an associated ID.me account likely exists.

- Districts can consider working with bus dealers, OEMs and charging companies to consider how elective pay can be included in the procurement process.

- When actually filing the tax return with the IRS, school districts can either choose to paper file (i.e. sending all required forms to the IRS’ address in the mail), or e-file using an authorized e-filing provider.

- A school district’s authorized representative should familiarize themselves with IRS’s Pre-Filing Registration Tool User Guide and Instructions, which details the application process and additional information about all direct pay eligible tax credits.

- Submitters should continue to refer to the IRS Elective Pay Frequently Asked Questions resource, as information around elective pay is evolving and an iterative process.

Stacking tax credits with grants and loans

Per IRS guidance, tax credits can be stacked with tax-exempt grants and forgivable loans. For electric school bus projects, this can include funding from EPA under the Clean School Bus Program, the Clean Heavy Duty Vehicle Program, and Diesel Emissions Reduction Act, as well as many other federal and state funding programs.

In determining how much a school district may receive in a tax credit, the IRS will look at the cost basis of the project – meaning, the total cost of the electric school bus or charging infrastructure. As articulated in the graphic below, a tax-exempt grant or forgivable loan is included in the calculation of the cost basis of the project (e.g., a $300,000 grant to purchase an electric school bus would be factored into the total cost of the project).

School districts can “stack” electric school bus tax credits with grants and loans to lower the total cost.

If the school district used its own funds, such as its transportation budget, these are considered “unrestricted funds” and do not affect the cost basis of the tax credit (e.g., a district using $50,000 from its transportation budget to cover the remaining cost of an electric school bus after receiving a federal grant would not reduce the value of the tax credit).

Additionally, if a school district received a general grant for sustainability projects and decided to use that money to purchase electric school buses, those funds would not be considered “restricted” under this rule. For more information, please refer to Lawyer for Good Government’s factsheet and the IRS’s elective pay FAQs under Q41.

After including the total value of the grant combined with the tax credit, these amounts cannot exceed the project's cost basis (i.e., the purchase price of the electric school bus or charging infrastructure). In such a case, the maximum value of the tax credit will be reduced to equal the total cost of the project.

Additional resources

- Office Hours hosted by IRS to support pre-filing registrations

- UndauntedK12’s Inflation Reduction Act webpage

- WRI’s Electric School Bus Initiative’s free 1:1 expert consults

- Elective Pay & IRA Incentives Resource Page – Lawyers for Good Government

- Ask a tax lawyer – a live FAQ portal and page updated by Lawyers for Good Government

Photo provided by Twin Rivers USD