Repowering the Transition to Electric in New York and Lowering Total Cost of Ownership

Explore how repowered school buses are bringing clean rides to students in New York — and check out our new repower total cost of ownership analysis!

The Electric School Bus Series shows how superintendents and fleet managers across the United States have pursued school bus electrification in their own communities. This edition explores repowered school buses through the example of a contractor who in 2021 became the first in New York to receive and operate a repowered school bus. This article is based on an interview with Corey Muirhead, Executive Vice President of Logan Bus Company. Additional information on repowers can be found in this article.

As more states, cities and school districts across the United States set electric school bus transition requirements, questions remain around how this technology can scale rapidly and efficiently. Electric repowers – sometimes referred to as an electric conversion or retrofit — present a compelling option to enable this shift.

A repower involves removing a vehicle’s internal combustion engine that runs on diesel, gasoline, propane or natural gas and replacing it with an electric drive system, transforming the vehicle to one that is fully battery-electric with zero tailpipe emissions. By re-using an existing bus body and chassis, fleets can opt for a vehicle that has lower up-front price and is more sustainable compared to buying a brand new electric school bus. Fleets interested in this innovative approach can learn from the example of Logan Bus Co. & Affiliates (Logan Bus) in New York, which operates the largest deployment of repowered school buses in the country.

Logan Bus is a New York City-based operator that manages 2,500 buses across 14 school districts with an equal mix of Type A and Type C vehicles. Their daily operations are substantial, transporting approximately 40,000 students across the city. Logan Bus received their first repowered bus in September 2021 and today operates five converted buses daily.

Motivation & Co-Benefits

In 2018, Logan Bus began exploring options to integrate electric school buses into their fleet and started discussions with NYC’s Department of Education on supporting a pilot project for repowered school buses. At the time, few electric bus models were available. Corey Muirhead, the Executive Vice President of Logan Bus, recognized the opportunity that repowering vehicles presented for large scale adoption of electric school buses, a transition that they would need to make.

Muirhead admits when he first heard of repowers he was skeptical, but this quickly changed when he learned that compared to new electric school buses, repowers can have around a third of the upfront purchase price, meet the same rigorous state and federal safety standards, and offer the same critical health benefits to students and communities. Muirhead was looking for the “biggest bang for the buck economically and environmentally” and found that in repowers, particularly in their ability to take a “diesel bus off the road immediately” while “extending the life of the bus” at a lower upfront cost compared to a new electric school bus.

In the summer of 2019, in partnership with a New York-based vehicle repower manufacturer, Unique Electric Solutions (UES), and charging and energy management provider AMPLY Power (now BP Pulse), Logan Bus was awarded $125,000 for each of five repowered school buses through New York’s Truck Voucher Incentive Program (NYTVIP). Charging infrastructure was covered through the utility, via Con Edison’s Make-Ready program. In 2021, Logan Bus became the first in the state to receive and operate a repowered school bus, laying a blueprint for others to follow.

From Muirhead’s perspective, repowering has been a no-brainer. “I figure if it’s electric, it’s electric. We care about the emissions, right? If it’s still passing New York State Department of Transportation inspections, the bus looks good, and it’s still safe in accordance with the National Highway Transportation Safety Administration, then what do I care if the body is 5 or 10 years old? I care about that diesel engine getting off the road.”

Logan Bus expects the converted buses to be on the road for at least another 10-12 years, a number they believe will only increase as technology improves.

Muirhead explained that to electrify at scale, repowers will need to be a part of the equation. This is particularly true in New York with the state’s two-step state-wide requirement that calls for 100% zero-emission school bus sales by 2027, and a 100% zero-emission statewide fleet by 2035. Within this framework, Muirhead pointed out that “in New York, if you buy a 2026 diesel bus, you won’t take it off the road before ten years. A portion of the industry will have to be repowered.”

Partners

Several partners collaborated to make Logan Bus’s electric school bus deployment possible:

Unique Electric Solutions (UES), a New York-based repower manufacturer that converted Logan Bus’s five Type C buses. UES met early on with Muirhead to talk about the opportunities that repowers offered Logan in their fleet electrification strategy. They also worked with Logan Bus throughout the conversion process, including with voucher application support.

AMPLY Power (now BP Pulse), the EV charging and energy management provider assisted Logan Bus with getting charging infrastructure installed. They also lead the NYTVIP application process and were the official awardee.

Con Edison, the local electric utility that supported with charger interconnection and provided feasibility studies on all of Logan’s bus yards, as well as funding for infrastructure through their Make-Ready program.

New York State Energy Research & Development Authority (NYSERDA), which administers the NYTVIP, and through which funds were provided for the five electric school bus repowers.

Pilot Status

In late 2019, Logan Bus provided UES with five 2011 IC Bus Type C school buses from their own fleet to be repowered. Following a year-long delay due to the COVID-19 pandemic and subsequent supply-chain challenges, the first converted bus began student pick-ups in September 2021. Two more hit the road in the fall of 2022, and by September of 2023 the remaining two buses began operations. At the time of the conversion, each vehicle was between 10-12 years old.

Conversion & Refurbishment

Once each bus was converted at UES’s facility in Long Island, technician staff at Logan Bus refurbished the interior and exterior of the school bus. This included upgrades such as a fresh coat of paint, new rub rails, replacing seats and welding out rust. With these cosmetic updates, Muirhead noted that most people have no idea that the bus is over 10 years old and has been converted to electric. He further explained that while most of these upgrades are not required, they do “make sure that we can stretch out that vehicle life for as long as possible.”

Overall, Muirhead added that what is required to refurbish a school bus will depend on how old the vehicle is. For this pilot, Logan Bus opted to convert 10-year-old buses but for newer vehicles, including those just out of warranty, very little work would be needed to address wear and tear. The bus’s condition is also a function of where it operates. For instance, buses running routes in colder climates with more corrosive conditions will show signs of rust sooner.

If he could do it over again, Muirhead says he would have chosen younger buses that recently exited their warranty period (commonly at five years) to reduce or avoid refurbishment needs which for Logan Bus were about $10,000 per bus.

Once the conversion and refurbishment are complete, like all new school buses, the vehicle must undergo inspection before transporting students. In NYC, this involves a series of approvals beginning with inspection by the New York State Department of Transportation, followed by the NYC Department of Education, after which GPS units are installed. Collectively, this process can take up to a month.

Performance & Expectations

For route selection, Logan Bus worked with Amply Power (now BP Pulse) to prioritize disadvantaged communities based on income and air quality levels. The final routes selected were those with simple, short and regular traffic patterns. Overall, the driver experience has been positive, and the five repowered vehicles are fully operational, each running AM and PM routes totaling between 16 and 32 miles daily. While the buses use only a fraction of their 150-mile total range, they have flexed their abilities by making the 344-mile round-trip journey between New York City and Albany, stopping once each way to recharge for 30 minutes at a DC fast charger.

While the repowered buses use only a fraction of their 150-mile total range, they have flexed their abilities by making the 344-mile round-trip journey between NYC and Albany, stopping once each way to recharge for 30 minutes at a DC fast charger.

The converted buses have been running daily routes for between two months and two years, and Muirhead says he is pleased with their performance. The process has not been without its challenges, much of which were encountered during the testing phase before the buses actually started running routes. In some instances, it required UES to make adjustments to the electrical system that integrates the new electric powertrain with the pre-existing bus components. Muirhead noted that while this can be a tedious process, “once they actually get on the road, they are great.”

With the school buses 10 years old at the time of the planned conversion, Muirhead anticipates they will be able to double that lifespan, adding, “that’s the highest achievable thing we can do here.”

Charging Infrastructure

While not unique to repowers, Logan Bus has found the charging equipment and its operation to be one of the more challenging aspects of the project. They currently have five 19.2 kW Level 2 chargers and one 60 kW Direct Current (DC) fast charger. One of the main issues encountered has been reliability of the older Level 2 chargers. The chargers themselves also take up a significant amount of space, making continued fleet electrification a challenge for an already space-constrained depot.

However, as technology continues to evolve, Muirhead looks forward to getting new chargers with improved reliability and lesser space requirements. He also hopes both charger and battery technology improve to the point that the buses will not require overnight charging, reducing the number of chargers needed.

For Muirhead, a key takeaway has been identifying hidden project costs that can appear for any electric school bus deployment, new or converted. Some examples he mentioned include infrastructure upgrades for charging equipment and being aware of how sales tax may or may not be covered by your grant funds for private operators.

Pushing forward

Logan Bus intends to grow the number of repowered and new electric school buses in their fleet. They continue to apply for funding opportunities, including completing an application for the EPA’s Clean School Bus Program (CSBP) 2022 rebate and 2023 grant, and plan to apply for the recently launched New York Electric School Bus Incentive Program.

New York Electric School Bus Incentive Program

On November 29, 2023, the application portal opened with $100 million in funding made available for the first round of the program for bus purchases. Both new and repowered electric school buses are eligible for the funding. Repowers are eligible for up to $171,000 per bus.

Inflation Reduction Act (section 45W) – Tax Credit for Qualified Commercial Clean Vehicles

This program administered by the Internal Revenue Service (IRS) and can provide up to $40,000 per vehicle for commercial clean vehicles, including electric school buses. Tax-exempt entities, such as school districts, are eligible.

Advice for Other Fleet Operators

At over 2,500 buses, Logan Bus Co. & Affiliates operates one of the larger school bus fleets in the country. Given this, Muirhead believes Logan Bus has a role to play in advancing the industry – including demonstrating that electric repowers are an option. Following Logan Bus’s lead, other operators in New York including Pioneer Transportation and Total Transportation have now also deployed repowered school buses.

Even with the lower upfront costs that repowers bring to the table, Logan Bus noted the important role that NYSERDA’s NYTVIP played in enabling the deployment, bringing the total cost of ownership far below that of a new diesel-burning school bus. Not all grants and funding programs currently include repowers as eligible vehicles, including the EPA’s Clean School Bus Program, but many state programs do. Beyond the vehicle price tag, funding programs for electric school buses should consider covering charging infrastructure costs for charging equipment, software, construction, and installation.

“If we care about electrifying and giving low-income neighborhoods and opportunity zones better air quality and lower emissions, then why wouldn’t you repower? Why wouldn’t you try it?” – Corey Muirhead, Logan Bus

Looking forward, Muirhead and Logan Bus are thinking critically about what the transition to electric school buses can look like. “Do we care about brand-new shiny electric, or do we care about the electrification of the industry? What are our priorities here? Do we want to fully adopt and electrify or do we only want to adopt for brand new? If we care about electrifying and giving low-income neighborhoods and opportunity zones better air quality and lower emissions, then why wouldn’t you repower? Why wouldn’t you try it?”

The Logan Bus deployment provides valuable lessons for other bus operators looking to electrify their own fleet and do so at a lower cost. With New York’s state-wide 2035 fleet requirement and 2027 sales requirement, a move that is now accompanied by a growing list of rules in other states and cities, repowers can help fleets meet those targets as a part of their electrification strategy.

Assessing Logan Bus’s Electric Repower Total Cost of Ownership (TCO)

Total Cost of Ownership (TCO) is the sum of all current and future capital and operating expenses associated with the ownership of an asset, and it’s an important consideration when purchasing a school bus. Over the lifetime of a new diesel, new electric, or repowered electric school bus – in all three instances – the upfront capital costs of the bus are the largest expense.

Today the average upfront purchase price of a new Type C electric school bus is about $375,000, three times more than a new diesel equivalent. This puts electric school buses, especially new models, at a disadvantage despite their lower fuel and maintenance costs. The upfront capital investment remains a primary barrier to school districts and bus contractors like Logan Bus, and these high costs disproportionately impact historically underserved communities who may have fewer resources to devote to school bus electrification. With this difference in upfront cost, funding and incentives make new electric school bus purchases possible today and can close the gap in TCO between a new electric and new diesel.

Comparatively, Logan Bus’s Type C repowers from UES were priced at $175,000, within the expected price range for a Type C repower of $150,000 to $200,000, making them more cost competitive with the fossil fuel options. For repowers, Logan Bus pointed out several key factors that can impact the upfront costs associated with an electric school bus conversion:

- Electric repower cost: Logan Bus was able to purchase their Type C repowers for $175,000 each. This was a key deciding factor for Logan Bus in adopting this technology. Much of the upfront cost was offset by a $125,000 voucher from the NYTVIP, leaving $50,000 for Logan Bus to cover.

- Refurbishment costs: Logan Bus invested about $10,000 per bus in cosmetic upgrades and other repairs. If younger buses, such as those just out warranty (commonly at five years), were used, these costs would have been lower or avoided altogether. Muirhead pointed out that Logan Bus has the equipment and staff to perform the refurbishment in-house – something that may cost more for other operators if the work is outsourced.

- Used bus cost (not applicable to Logan Bus): If a used bus must be purchased for the conversion, the price of the used bus will add to the upfront costs. For Logan Bus, the vehicles came from their fleet, resulting in no additional upfront cost to the TCO.

- Potential internal combustion engine bus resale value (not applicable to Logan Bus): Some operators intend to sell vehicles at a certain age and factor that future sale into their business model. Logan Bus has a target vehicle lifecycle but does not factor in resale value.

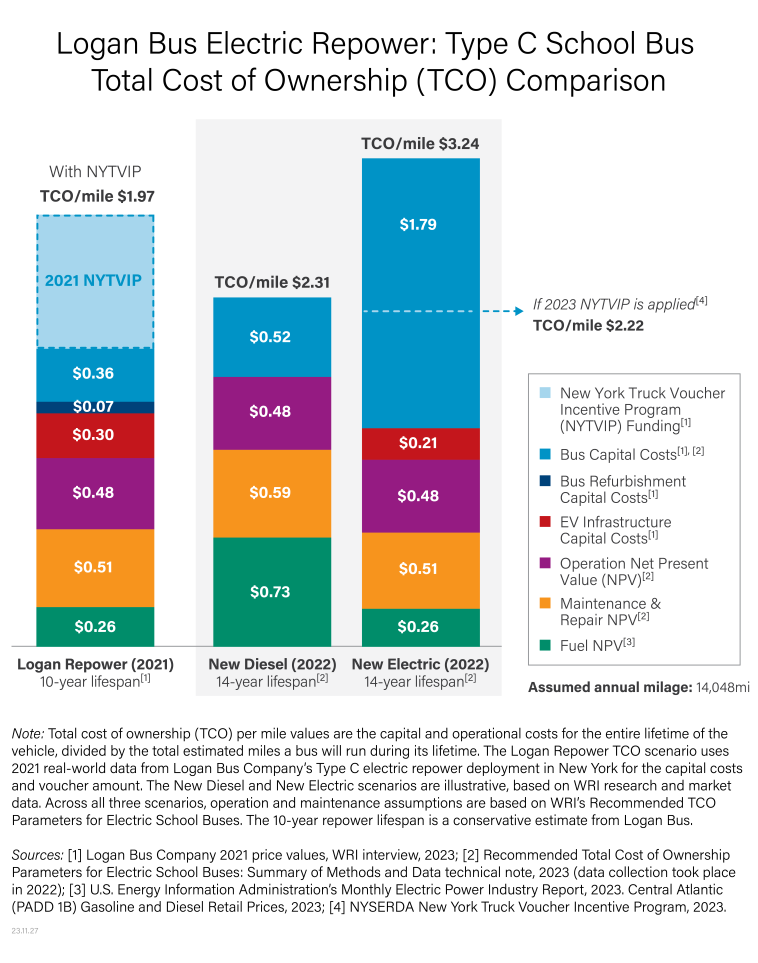

Using real-world upfront cost information from the Logan Bus repower deployment, combined with data assumptions, the graph below shows a TCO comparison between a 2021 Logan Bus Type C repower, 2022 new diesel-burning school bus and 2022 new electric school bus. For each scenario, the graph showcases the estimated TCO per mile, calculated by taking the vehicle’s entire lifetime costs divided by the total estimated miles the bus will run during its lifespan.

Using NYTVIP funding, each Logan Bus repower is estimated to cost $0.34 less per mile compared to a new diesel-burning school bus over their respective lifespans.

If all goes according to plan, Logan Bus expects the repowers to operate for at least 10-12 years. For the calculations below, a conservative 10-year lifespan is assumed for the repower. Comparatively, a 14-year lifespan is assumed for a new diesel-burning school bus and new electric school bus. The longer a bus runs for, the lower a vehicle’s TCO per mile will be because the total capital and operating costs are spread across more miles. A repower operating for longer than 10 years could result in even greater savings.

Logan repower vs. new diesel-burning school bus: At a TCO per mile of $1.97 (including NYTVIP), each Logan Bus repower is estimated to cost $0.34 less per mile compared to a new diesel-burning school bus ($2.31 TCO/mile) over their respective lifespans. This is impressive considering that the repower is calculated to operate for four years less, or 56,192 miles fewer, than the new diesel-burning school bus. With more years, the per mile costs for the repower would be further lowered.

Logan repower vs new electric school bus: The new electric school bus has an estimated TCO per mile of $3.24. The Logan Bus repower is estimated to cost $1.27 less per mile with the NYTVIP funding. The bulk of this difference can be attributed to the new electric school bus’s higher upfront price. As of 2023 in New York, new electric school buses are also eligible for NYTVIP funding of around $200,000 per vehicle. As depicted in the graph, that amount of funding can bring the TCO of a new electric school bus to parity with that of a new diesel-burning school bus.

Overall, the lower upfront capital costs of the Logan Bus repower, combined with the reduced fuel and maintenance costs that all electric school buses offer, make a compelling case for repowering school buses. Modifications to the repower scenario, such as little to no refurbishment costs, or a longer estimated lifespan could demonstrate an even stronger cost case for repowers.